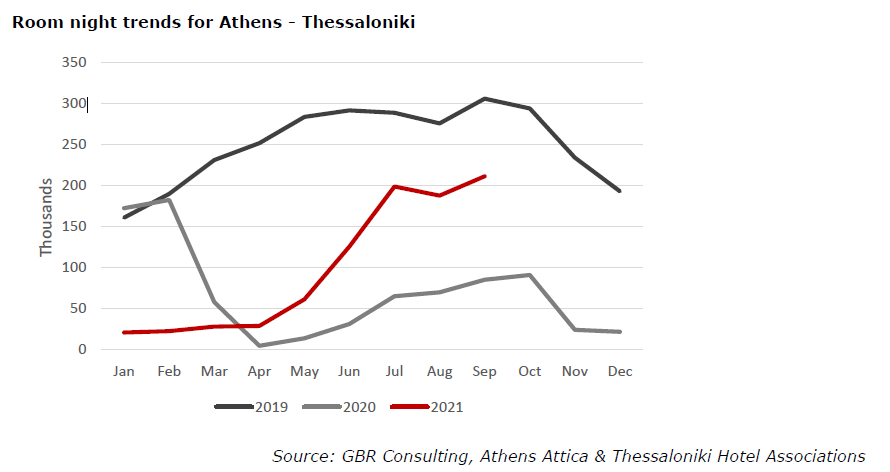

Data up to September shows that the Athens and Thessaloniki hotel markets recovered to a level of 39% in terms of room nights compared to the same period of 2019. Room supply has been restored to pre-pandemic levels. In August, Athens recorded a level of 71% of 2019 in terms of room nights, while September registered 66%. Contrary, Thessaloniki recorded 61% in August and 75% for September comparing room night levels between 2021 and 2019.

The resort hotels in our database reached in terms of room nights levels of 89% and 86% during August and September respectively compared to the same months of 2019.

YTD Sep the resort hotels were at a level of 57% compared to 2019 with the recovery starting in May / June.

YTD Sep the resort hotels were at a level of 57% compared to 2019 with the recovery starting in May / June.

The Total Revenue per Occupied Room at resort hotels was significantly higher than the same period of 2019, which was likely fueled by the available excess savings of consumers accumulated during the pandemic.

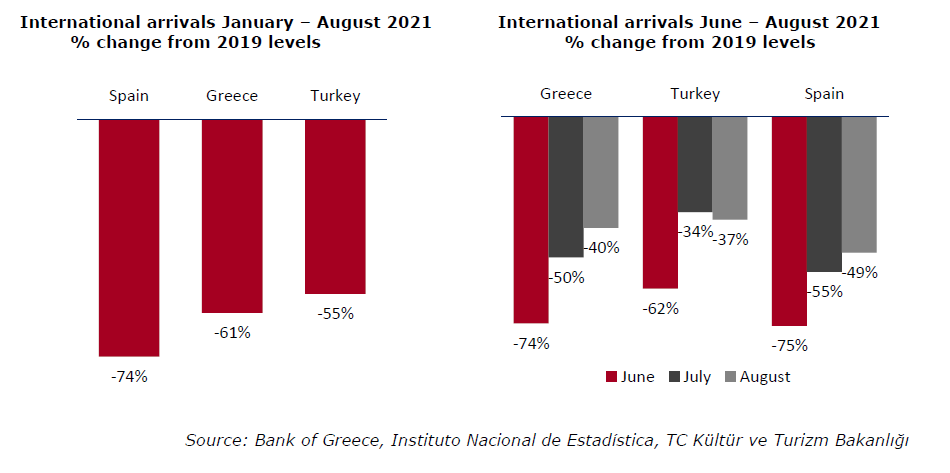

Greece is recovering at a faster pace than Spain

Approximately 8.6 million international tourists travelled to Greece in the period of January – August 2021, a drop of 61% compared to the same period in 2019.

Competitor Spain registered 15.0 million international arrivals YTD August 2021 compared to 58.1 million in 2019, a drop of 74%.

Competitor Spain registered 15.0 million international arrivals YTD August 2021 compared to 58.1 million in 2019, a drop of 74%.

The rebound of the tourism sector in Turkey was stronger than Greece and Spain as the country recorded a drop of 55% in international arrivals during the reviewed period. Up to August 2021 Turkey received 14.1 million international arrivals, while same period in 2019 31.0 million tourists travelled to the country.

The recovery in Turkey was particularly strong in July. Each of the months of June, July and August the Turkish market outperformed the Greek and Spanish market.

Greece performed better than Spain, especially during July and August.

Greece performed better than Spain, especially during July and August.

Travel restrictions still high despite vaccine progress

International travel remains affected by a number of factors. Globally travel restrictions remain high despite vaccination progress. Restrictions are expected to be eased slowly and gradually. Some countries remain very risk averse which will delay the recovery process.

Vaccination progress differs per region and per country. High income countries and upper income countries show the highest vaccination rates, while low income countries clearly stay behind.

Vaccination progress differs per region and per country. High income countries and upper income countries show the highest vaccination rates, while low income countries clearly stay behind.

In Portugal and Spain 87% and 80% respectively of the population has been vaccinated making it safe countries to visit, while Greece has reached 61% so far. Also Turkey has stayed behind with 57%, while Balkan countries Romania and Bulgaria, which are important for the Greek tourism sector, only managed to vaccinate 31% and 21% respectively of their population as depicted in the graph below.

Furthermore, a reluctancy to international travel remains to avoid infections, masks, social distancing, tests and forms. High vaccination rates will reduce reluctancy further.

As demonstrated in earlier newsletters, once travel bans are lifted, bookings are rising.

After a drop of GDP in the Eurozone of 6.5% during 2020, a growth of 5% is expected, followed by 4.5% in 2022, 2.4% in 2023 and 1.4% in 2024 according to Oxford Economics. However, inflationary pressures and supply-side disruptions currently weigh on the outlook.

The risk of further restrictions due to Covid-19 has not disappeared. Lingering restrictions on some indoor activities and a degree of social distances could dampen services activity, particularly if the Delta variant causes a surge in infections.

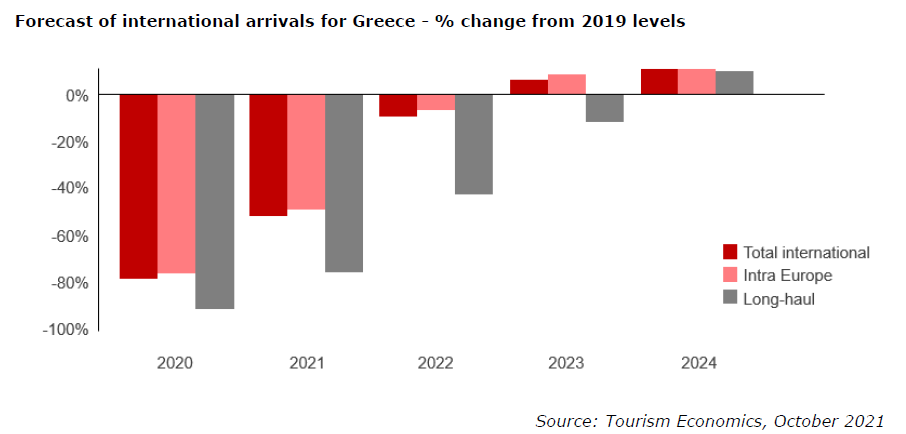

Greek tourism market: full recovery expected in 2023

According to forecasts of Tourism Economics of October 2021, the Greek tourism market will recover strongly in 2022.

Full recovery is expected in 2023, while long haul travel to Greece is forecasted to recover in 2024.

Transactions

In October 2021 it was reported that Zetland Capital, a private equity company based in London, acquired the 5-star Lindian Village in Rhodes from the Svyriadis family for about € 27 million. Market sources mentioned that the 188-room property will carry an international hotel brand. The deal is expected to be finalized at the beginning of 2022.