International tourist arrivals reached 1,014 million in the first ten months of the year, according to the data included in thisissue of the UNWTO World Tourism Barometer. BetweenJanuary and October 2015,43 million more tourists (overnight visitors) travelled to international destinationsaround the world compared to the same period last year,

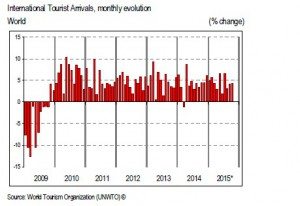

International tourist arrivals reached 1,014 million in the first ten months of the year, according to the data included in thisissue of the UNWTO World Tourism Barometer. BetweenJanuary and October 2015,43 million more tourists (overnight visitors) travelled to international destinationsaround the world compared to the same period last year,corresponding to an increase by 4%.

Despite the on going challenges, de mand fo r internationaltourism rem ains ro bust, with growth in arrivals exceeding the long-term average for the sixth year in a row. Since the post-crisis year 2010, international arrivals have grown at a pace of 4% a year or higher. In 2012, international tourist arrivals exceeded the 1 billion mark in a year for the first time. Only three years later, this number was already reached in the first ten months of theyear. The period January-October normally accounts for around 86% of the total annual international arrivals count.

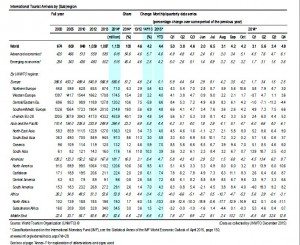

Europe, the Americas and the Middle East led growth, all recording a 5% increase in international tourist arrivals between January and October 2015 compared to the same period of 2014.

Europe, the Americas and the Middle East led growth, all recording a 5% increase in international tourist arrivals between January and October 2015 compared to the same period of 2014.Arrivals i ncreased by 4% in Asia and th e Pacific, while limited data available for Africa points to an estimated 5% decrease in the number of international tourists.

Despite global cha llenges, including increased safety and security concerns, international tourism continues to grow firmly.

Although current data does not yet ref lect the impact of recent terrorist attacks in different parts of the world, experience showsthat the effect of such events on tourism demand is rather limitedand s hort-lived. W e t hus do n ot fore see glo bal to urism being

significantly a ffected” sa id UNWTO Secre tary-General, Taleb Rifai.

“Security is a prerequisite for tourism and is a priority for us all. In this respect, UNWTO urges governments to include tourismadministrations in th eir national se curity planning andimplementation structu res a nd pr ocedures, not only to ensure that the sector’s exposure to threats is m inimised but also to maximise the sector’s ability to support  security and facilitation,as seamless travel and safety go hand in hand”, he added.

security and facilitation,as seamless travel and safety go hand in hand”, he added.

security and facilitation,as seamless travel and safety go hand in hand”, he added.

security and facilitation,as seamless travel and safety go hand in hand”, he added.Regional Results

Europe, the most visited region in the world, recorded a 5% growth between January and October 2015 fueled by a weaker euro and a gradually improving economy. Central and Eastern Europe (+7%) rebounded from last year’s decrease in arrivals.

Northern Europe (+6%), Southern Mediterranean Europe (+5%) and Western Europe (+4%) all recorded sound results, especiallyconsidering these are subregions with many mature destinations.

Asia and the Pacific recorded a 4% increase in international tourist arrivals through October, with uneven re sults across destinations. Growth was led by Oceania (+7%) and South-EastAsia (+5%), while in South Asia and in North-East Asia arrivals grew by 4%.

Asia and the Pacific recorded a 4% increase in international tourist arrivals through October, with uneven re sults across destinations. Growth was led by Oceania (+7%) and South-EastAsia (+5%), while in South Asia and in North-East Asia arrivals grew by 4%.International arrivals in the Americas grew by 5%, consolidating last year’s strong results (+8% in 201 4). The appreciation of the US dollar stimulated outbound travel from the

United States, ben efiting the Caribbean and Central America, both with a 7% growth in arrivals. Results in South America and North America are m ore moderate (both +4%), though following robust growth in 2014.

Lιmited available data for Africa points to a 5% decrease in arrivals, with North Africa at minus 10% and Sub-Saharan Africa declining by 2%.

International tourist arrivals in the Middle East grew by anestimated 5 %, consolidating the r ecovery that start ed i n 20 14.

(Data for both Africa and Middle East should be read with caution as it is based on limited available data.)

China, the United States and the United Kingdom lead outbound travel growth in their regions

China, the United States and the United Kingdom lead outbound travel growth in their regionsOutbound tourism flows have been influenced to a large extent by the rather strong exchange rate fluctuations in 2015. A few leading so urce markets have driven tourism expenditure both within and outside their respective regions, supported by a strong

currency and economy.

Among the world’s top source markets, China, with double-digit growth in expenditure every year since 2004, continues to drive outbound travel in Asia and beyond, benefitting particularly Japan, Thailand, as well as the United States and various European destinations. The United States (+9%) led expenditure in the Americas, generating visitors to m any destinations in the region on the back of a strong US d llar and a comparatively solid economy. Boosted by a stronger pound, tourism expenditure

from the United Kingdom (+5 %) s pread a cross destinations in Europe, as did to a lesser extent spending from Germany andItaly (both +2%).

By contrast, expenditure from the previously very dynamic source m arkets of the Russian Federation and Brazil was significantly down, reflecting the economic constraints in both emerging markets and the depreciation of the rouble and the real against virtually all other currencies. As for the traditional advanced economy source markets, demand from France, Canada and Australia was weaker, partly as a result of the

depreciation of their currencies against the US dollar.