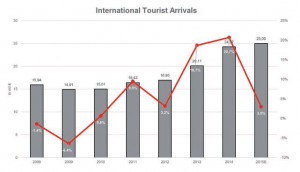

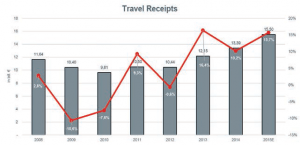

The Greek tourism industry had an exceptional year in 2014 following a strong 2013 with international tourist arrivals increasing by 21% and travel receipts by 10%. In 2015, as a result of continuous political instability and imposed capital controls, it was believed that the upward trend of Greek tourism would be interrupted. The industry, however, proved resilient. According to the Deputy Minister of Tourism, 2015 is expected to be a record year with arrivals estimated at 26mil. tourists and travel receipts projected at €15.5bil.

The Greek tourism industry had an exceptional year in 2014 following a strong 2013 with international tourist arrivals increasing by 21% and travel receipts by 10%. In 2015, as a result of continuous political instability and imposed capital controls, it was believed that the upward trend of Greek tourism would be interrupted. The industry, however, proved resilient. According to the Deputy Minister of Tourism, 2015 is expected to be a record year with arrivals estimated at 26mil. tourists and travel receipts projected at €15.5bil.

The market for hotels remained hot in 2014 and 2015 as a result of the continuous

growth in Greek tourism from 2013. New 5 and 4 star hotels have entered the market

with new international operators establishing a presence and big players extending their

positions. Marriott International returned to the Greek market with its Autograph

Collection Hotels brand via the Domes of Elounda hotel in 2015. Four Seasons Hotels

Resorts is planning to operate a new hotel in Mykonos; Carlson Rezidor Group will operate the Radisson Blu Beach Resort (ex Minos Imperial Luxury Beach Resort and Spa) in Lasithi, Crete from 2016; and Intercontinental has agreed to manage the operations of a new hotel in Santorini.

Grecotel Hotels and Resorts group aims to increase its position to 35 from 30 hotels and upgrade existing units. In 2015 two of the group’s luxury establishments in Rethymno, Crete, Caramel Grecotel Boutique Resort and White Palace Grecotel Luxury Resort reopened their doors. Earlier in 2014, Grecotel introduced the refurbished Pallas Athena Grecotel Boutique hotel in the centre of Athens which was added to the international network of small luxury hotels of the world.

A trend is emerging in Athens with a number of new hotels expected to open in 2016. Electra Hotels and Resorts leased the ex Ministry of Education building on Mitropoleos street in Athens’ city centre and has begun the development of a 5 star hotel totalling 220 rooms. Further down on Mitropoleos street, the listed building that used to house the renown Hytiroglou store is set to be converted into a boutique hotel by one of the

major local hotel groups. Mage Hotels and Resorts, leaseholder of the Fashion House Hotel in Omonia Square is to refurbish it into a 4 star hotel.

Furthermore, a tender for the letting of the Athens Lycabettus that closed in June is underway. In the northern suburbs, Domotel Hotels and Resorts opened its new 5 star Domotel Kastri hotel, comprised of 86 rooms, in Nea Erythraia in October 2015.

The 5 and 4 star hotel market in Greece has and is continuing to attract increased interest from national and international investors. Investors are also waiting for how the banks will ultimately begin to treat hotel NPLs. Greek institutional banks hold a significant portfolio of prime hotels and according to the Bank of Greece the value of those NPLs at the moment stands at €2.5bil while an additional €3.0bil. are in 90 days delay. NAI Hellas estimates

that the market value of 5 star hotels in Greece exceeds €10.0bil. while the market value of 4 star hotels is approximately €6.5bil.

The market values of hotel rooms in Greece are estimated to range between €35,000 to €65,000 for secondary 4 star hotels while prime 4 star hotel rooms range between €65,000 and €95,000. Market values of rooms of 5 star hotels are estimated to range from €100,000 to €160,000, depending on the location of the hotel. For the 5 star luxury category, market values of rooms are estimated to be far higher than that of the 5 star category, and range between €200,000 and €400,000.

The steady positive performance of Greek tourism increased turnover and EBITDA for the industry and has consequently allowed for new investments and the upgrading of existing stock.

In 2014 world tourism grew for the fifth consecutive year since the crisis with 4.3% more tourist arrivals globally than in 2013. The World Tourism Organisation expects a 3.0% to 4.0% year on year increase in 2015. European tourist arrivals, which are the world’s highest given that Europe is the most visited region globally, grew by 2.7% reaching over 581mil., with Southern and Mediterranean Europe leading the growth with a 6.9% increase from 2013. International tourism receipts increased by 3.7% in 2014 to €937.0bil. globally. Europe holds 40.9% of the world’s tourist market share of which EU-28 accounts for 33.9%.

Greek tourism had an exceptional year in 2014 following on from a very good 2013 season. International tourist arrivals increased by 20.7%, travel receipts grew by 10.2% and non-residents overnight stay improved by 14.7%. Greek airports welcomed almost 2.0mil. more visitors in 2014 than in 2013 and road arrivals increased by 49.0%.

In the first half of 2015 international arrivals increased by 18.8% compared to H1 2014 mainly as a result of a 51.3% increase in arrivals from EU member countries. In particular, arrivals from Germany increased by 23.5%, by 12.5% from France and by 18.0% from the United Kingdom. Arrivals from Russia decreased for this period by 60.6%.

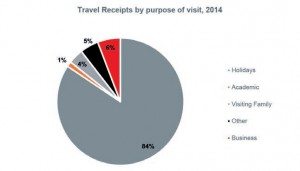

In 2014, travel receipts grew by 10.2% compared to 2013, taking into account receipts from cruises that increased by 10.0%. In H1 2015 travel receipts increased by 9.5% to €2.65bil. compared to that of H1 2014 mainly as a result of an increase in receipts of

EU member states’ citizens. Receipts from business trips increased in 2014 by 22.4%, yet are still very low compared to pre-crisis levels. The largest share of receipts, 84.3%, comes from holiday trips.

Non-residents overnight stay in Greece increased in 2014 by 14.7% compared to 2013, totalling 186.9mil. stays. In H1 2015 overnight stays increased by 6.7% compared to H1 2014 mainly due to an increase in the number of stays from citizens of EU member states. Overnight stays of citizens from outside the EU fell by 14.0%.

Non-residents’ expenditure per journey decreased from €604.0 in 2013 to €552.0 in 2014 and by 10.0% in H1 2015 compared to H1 2014. In 2014 the average expenditure per journey in Europe as a whole stood at €660.0 while that of the Southeast was €700.0, hence leaving Greece far behind its region’s average. Expenditure per overnight stay in

2014 fell to €71.6 from €74.0 in 2013 but increased in H1 2015 by 12.8% from the same period last year.

Average duration of stay decreased to 7.7 days in 2014 from 8.1 days in 2013 and by 10.2% in H1 2015 compared to H1 2014.

Greek tourism is affected by high seasonality levels. The Greek tourism seasonal deviation (the average of the absolute deviations of monthly data points form their mean) is 6.8, the second highest rate among EU-28 member states after Croatia, which is 8.9, and much higher than the EU-28 average of 3.4. Eurostat research reports that in 2014 82.6% of nights spent annually in accommodation establishments in Greece were during the months May to September, while for the same period for Spain nights spent resulted in 59.6%, 68.2% for Italy and 60.7% for Portugal. As such, the seasonality of Greek tourism is far higher than the rest of the EU Mediterranean countries.

The 5 month summer period (May to September) in 2014 realised 80.6% of the year’s total international arrivals, 81.6% of total overnight stays and 83.4% of total travel receipts, highlighting the dominance of the Greek sun & beach product against other touristic products.

The 5 month summer period (May to September) in 2014 realised 80.6% of the year’s total international arrivals, 81.6% of total overnight stays and 83.4% of total travel receipts, highlighting the dominance of the Greek sun & beach product against other touristic products.

Seasonality is also reflected, of course, in the operation of the country’s hotels. About 50% of 5, 4 and 3 star hotels in Greece operate on a seasonal basis and can be characterised as ‘resort’ hotels while the other half operate all year round and are categorised as ‘city’ hotels. Lower star category hotels that operate seasonally are approximately 10% more than those of higher categories.

According to the Travel and Tourism Competitiveness Report 2015 that is published every two years by the World Economic Forum that measures a destination’s tourism attractiveness, Greece ranked 31st (out of 141 countries) – marginally better than 32nd in 2013 – and 18th in Southern and Western Europe (out of 37 countries) from 22nd in 2013. Greece lags behind its main competitors who managed to improve their position considerably between 2013 and 2015, as they focused on emerging markets and on business travellers. Spain ranked 1st from 4th in 2013 and Italy moved to 8th place from 26th in 2013. Greece rates low in price competiveness and business environment but ranks high in the health and hygiene area (9th) and tourist service infrastructure (12th).

According to the Travel and Tourism Competitiveness Report 2015 that is published every two years by the World Economic Forum that measures a destination’s tourism attractiveness, Greece ranked 31st (out of 141 countries) – marginally better than 32nd in 2013 – and 18th in Southern and Western Europe (out of 37 countries) from 22nd in 2013. Greece lags behind its main competitors who managed to improve their position considerably between 2013 and 2015, as they focused on emerging markets and on business travellers. Spain ranked 1st from 4th in 2013 and Italy moved to 8th place from 26th in 2013. Greece rates low in price competiveness and business environment but ranks high in the health and hygiene area (9th) and tourist service infrastructure (12th).

Based on tourism receipts, Greece had a global market share of 1.8% in 2014 and 3.8% in Europe. Between 2013 and 2014 Greece’s main competitor countries presented positive results in terms of arrivals and receipts but did not manage to outperform that of Greece. In 2014, Portugal increased receipts by 12%, whereas Greece reported an 11% increase,

Based on tourism receipts, Greece had a global market share of 1.8% in 2014 and 3.8% in Europe. Between 2013 and 2014 Greece’s main competitor countries presented positive results in terms of arrivals and receipts but did not manage to outperform that of Greece. In 2014, Portugal increased receipts by 12%, whereas Greece reported an 11% increase,

without taking into account income generated from cruises.

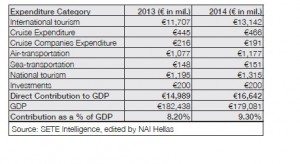

The direct and total contribution of Travel and Tourism to Greek GDP in 2014, as measured by the World Travel and Tourism Council, shows the importance of the sector to the economy, as outlined in the table below. Direct and total contribution of Greek tourism to GDP is forecasted to grow by 3.6% and 3.7%, respectively, each year until 2025. This means that the Greek tourism market is expected to experience strong future growth, yet less than that projected for direct competitors such as Turkey, Cyprus and Malta.

In 2014 the Greek tourism industry’s direct contribution to the country’s GDP totaled €16.6bil. or 9.3% of total GDP, as per Greek Tourism Confederation estimates. This amount includes income that is sourced from national tourism, air and sea transportation, estimated at €1.3bil., €1.2bil. and €151.0mil. respectively, as well as €466mil. from cruise tourism spending.

A significant multiplier effect is evident as a result of the tourism industry’s total impact on the overall economy. For every €1 spent from tourist activity, additional (indirect) economic activity is created. The Foundation for Economic and Industrial Research calculated this multiplier for tourism to be 2.2, hence every €1 spent creates an additional €1.2, thus adding €2.2 in total to GDP. The contribution of Greek tourism to the economy is thus significant both on a direct and total contribution basis.

Research conducted by the Centre of Planning and Economic Research resulted in a higher multiplier effect than that described above, with the multiple calculated to be 2.65. The tourism multiplier is broken down into subsectors of the economy.

Taking into account all additional economic benefits the tourism industry creates as result of the multiplier effect, it is estimated that the sector contributes in total between €37bil. and €44bil. or 20%-25% of GDP.

With tourism activity concentrated over several areas of the country, prime tourism locations such as Crete, the islands of the Southern Aegean and the Ionian Sea, see the industry contribute up to 50% to their GDP.

Contribution to employment in 2014, as per the Greek Insurance Fund for Employees, from the tourism industry increased by 23% compared to 2013. Total remuneration of employees in the tourism industry reached €3.8bil., €500mil. higher than the year prior. In July 2014 alone over 500,000 employees were registered in the industry, or 1 out of 3 workers in the registered labour force. As shown in the below graph, the turnover index for accommodation and food services for 2014 increased by 13.7%, showing a clear acceleration in the growth rate compared to the previous year (+ 4.8%). In the second

quarter of 2015 the turnover index increased by 13.0% compared to the same quarter of 2014, evidencing the strength of the current year’s performance.

The Greek hotel stock in H1 2015 amounted to a total of 9,706 hotels comprised of 403,792 rooms and 779,118 beds. Hotel capacity in Greece increased from 2000 by 23.5%. The average size of Greek hotels in terms of rooms reached 41.6 rooms in 2014, an increase of 5.9% from 39.3 rooms in 2000. As such, although the percentage increase in hotel establishments for the period 2000-2014 was 23.5%, growth in number of rooms was 30.4%.

As presented in the following graph, approximately 60% of 5 star hotels in Greece have over 101 rooms while only 0.1% of 1 star hotels are of similar size. The largest percentage of 4 star hotels belong to the ‘Family’ and ‘Small’ hotel categories and merely 25% of them belong to the ‘Large’ hotel category. Between 2013 and 2014, the category breakdown for each type of hotel showed no significant changes except for a 7% increase in 5 star hotels of the ‘Family’ category. This means there has been an increase in supply of ‘Boutique Luxury’ units.

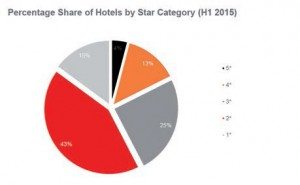

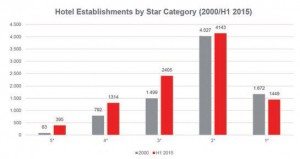

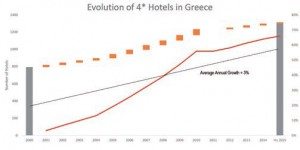

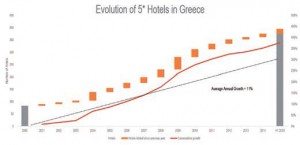

Considering the growth of hotel units in Greece according to their star category during the period 2000 – H1 2015, it is clear that the hotel stock of the country has been significantly upgraded. Five star hotels quadrupled, being the category with the highest growth. Four star hotels grew by 66% in the same period and account for 13% of the total stock (from 9.8% in 2000). Three star hotels increased by 62%, yet their share remained constant over the years. Contrastingly, the share of total stock of each of the two lowest categories fell since 2000. Two star hotels increased marginally by 3% between 2000 – H1 2015 while one star hotels decreased by 13%. In H1 2015, the top 3 star categories constituted approximately 60% of hotel stock.

Considering the growth of hotel units in Greece according to their star category during the period 2000 – H1 2015, it is clear that the hotel stock of the country has been significantly upgraded. Five star hotels quadrupled, being the category with the highest growth. Four star hotels grew by 66% in the same period and account for 13% of the total stock (from 9.8% in 2000). Three star hotels increased by 62%, yet their share remained constant over the years. Contrastingly, the share of total stock of each of the two lowest categories fell since 2000. Two star hotels increased marginally by 3% between 2000 – H1 2015 while one star hotels decreased by 13%. In H1 2015, the top 3 star categories constituted approximately 60% of hotel stock.

The average size of Greek hotels in terms of rooms

The average size of Greek hotels in terms of rooms  reached 41.6 rooms in 2014, an increase of 5.9% from 39.3 rooms in 2000. As such, although the percentage increase in hotel establishments for the period 2000-2014 was 23.5%, growth in number of rooms was 30.4%.

reached 41.6 rooms in 2014, an increase of 5.9% from 39.3 rooms in 2000. As such, although the percentage increase in hotel establishments for the period 2000-2014 was 23.5%, growth in number of rooms was 30.4%.

As presented in the following graph, approximately 60% of 5 star hotels in Greece have over 101 rooms while only 0.1% of 1 star hotels are of similar size. The largest percentage of 4 star hotels belong to the ‘Family’ and ‘Small’ hotel categories

and merely 25% of them belong to the ‘Large’ hotel category. Between 2013 and 2014, the category breakdown for each type of hotel showed no significant changes except for a 7% increase in 5 star hotels of the ‘Family’ category. This means there has been an increase in supply of ‘Boutique Luxury’ units.

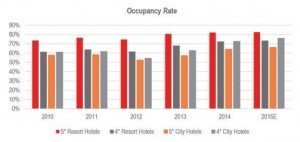

Occupancy Rate

Hotels overall in Greece suffered a difficult year in 2012 with falling occupancy rates. The growth of tourism in 2013 and 2014 helped occupancy rates increase, with 5 star resort hotels showing more resilience while occupancy rates of 4 star hotels were more volatile. In 2015 city hotels recorded high occupancy rates heightening investor interest.

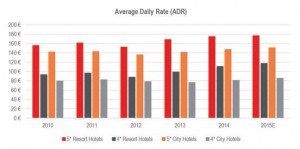

Average Daily Rate (ADR)

Average Daily Rate (ADR)

Average daily rates of resort hotels were much higher than that of city hotels, given that they operate on a seasonal basis and offer all inclusive packages.

5 star city hotels experienced less of a discount on ADRs between 2010-2015 than 4 star hotels since they went through a significant correction prior to 2010. 4 star city hotels presented low ADRs during 2013 aiming to maintain high occupancy rates.

RevPAR

The difference in RevPAR results for 5 star resort and city hotels reflects the high occupancy apparent during the resort season compared to that of the whole year for the city hotels. The same relationship is not evident for the 4 star hotel category given that the resort and city occupancy rates show less of a discrepancy.

The difference in RevPAR results for 5 star resort and city hotels reflects the high occupancy apparent during the resort season compared to that of the whole year for the city hotels. The same relationship is not evident for the 4 star hotel category given that the resort and city occupancy rates show less of a discrepancy.

Investment

Greek hotels fared remarkably well in 2014 and 2015 with resort hotels presenting stable growth in key performance indicators. However, the country’s leading performer for 2015 were the Athenian city hotels. Particularly, during the summer and au tumn months of 2015 city hotels in Athens recorded remarkably high occupancy and ADRs. Athens is becoming a travel destination city and as such investment activity in the hotel sector in Athens is on the rise.

tumn months of 2015 city hotels in Athens recorded remarkably high occupancy and ADRs. Athens is becoming a travel destination city and as such investment activity in the hotel sector in Athens is on the rise.

Villa & Holiday House Rental Environment

The rapid growth of Airbnb, Homeaway and other online platforms that have infiltrated the travel accommodation market in Greece since 2010, have created a new player in the hospitality market. The growth of world travelers in combination with high hotel rates and demand to travel at low cost made these platforms very popular. Platforms such as Airbnb, with a market cap estimated at $24bil., are worth more than some of the world’s biggest hotel chains. The growth of this market in Greece is the result of a combination of global and domestic factors. The primary factor contributing to the growth of villa

rentals is the increased global trend of travelling the world, with low accommodation costs, low flight costs and within an environment that allows the traveler to experience the life of a local. Globalization’s new trend is glocalization. Travellers are looking to experience the life of a Londoner, a Parisian, a Madridian and an Athenian through spending their holidays at a villa, a house or a flat in the heart of the city. Furthermore, the cost of staying at a 5 star hotel is higher than that of renting a villa or a house. Villa and house rental rates are considered to be a value for money choice for travelers in relation to star hotel room rates. In Greece, high property taxation and maintenance costs have pushed owners of holiday villas and homes to join the villa rental market as it is a very good way to produce income from the property. The outcome is that Airbnb and other house and villa rental platforms have gained a large market share in hospitality.

After the tourism boom of 2013, Greek villa and holiday house owners are looking more and more to include their villa in the short term seasonal summer rental market. The passing of Law 4179/2013 boosted the market’s repute by giving it an institutional framework that secures its sustainability. Based on the new legislation, Greek villa rental owners are obliged to register their villa with the Ministry of Tourism. As of 31/12/2014, approximately 6,500 villas were registered with the Ministry of Tourism.

Greek Villa Rental Market Rates

The Greek villa rental market is concentrated in some of the most popular Greek tourist destinations such as Mykonos, Santorini, Rhodes, Corfu, Paros, Crete and the islands of the Saronic Gulf. Rates for villas range from €28.83/person/day/room in Rhodes and reach up to €190.83/person/day/room in Santorini. All rates are net and exclude additional charges (15% – 30%) that travellers pay for management, villa brokerage services, travel brokerage etc. On the other hand, Greek hotel room rates (based on standard room rates and excluding high end accommodation) begin at €48.19 for a 5 star hotel in Rhodes and reach €233.75 for a 5 star hotel in Mykonos.

In order to conduct a comparative analysis of the Greek villa rental market several European villa rental markets were researched including St. Tropez (FR), Sicily (IT), Capri (IT), Bodrum (TR) and Ibiza (ES). On average, Greek villas offer more competitive rates than that of similar destinations in Europe. Rhodes villa rental rates are the most inexpensive while rates in Mykonos, the country’s most expensive destination, are still lower than those of Capri and Ibiza. Similar to the villa rental market, Greek hotels in prime touristic destinations also continue to offer more competitive prices than hotels in top European destinations during the holiday season.

When comparing the relationships villa rates have to hotel rates in Greece and in Europe, an disimilarity is found to exist. Average rates for Greek rental villas are more similar to the country’s hotel rates compared to that in Europe, with the exception of Ibiza. European villas, hence, on average offer significantly lower rates compared to 5 star hotels. In addition, villa rates in Greece are more similar to hotel rates during off-peak season than they are during peak season, implying that hotels offer competitive pricing during low seasons in order to achieve higher occupancy rates and expand their

tourist season. This causes villas to be priced out of the market, to an extent, during the off-peak months, whereas in European destinations villa rentals maintain their lower cost accommodation standing throughout the holiday season. This is a reasonable outcome given that hotels are managed by professional operators or experienced family teams who closely monitor the market, while villa owners are individuals with relatively limited knowledge of the market and its dynamics.

Villa rental management companies are still relatively few compared to the size of the market and pricing strategies are continuously being adjusted to bridge the gap between market rates and owners’ expectations.

The villa rental market in Greece is relatively new and still quite immature. Rates for villas and holiday homes in Greece are still formed largely based on the owner’s perception of what his/her property is worth mainly because the market used to be relatively small. Hotel rates, of course, on the other hand are formed based on market dynamics of demand and supply.