In its latest analysis IATA highlights a slight recovery as far as the domestic flights are concerned related to April’s data.

More specifically:

• Industry-wide revenue passenger-kilometres (RPKs) contracted by 91% year-on-year in May, compared to the 94% annual decline observed in the last month.

• The slight improvement from the low point in April was driven by developments in domestic markets. International

RPKs fell by close to 100% year-on-year for the second consecutive month.

• Despite widespread aircraft grounding and flight cancellations, global passenger deman

Pressure on passenger volumes eased modestly

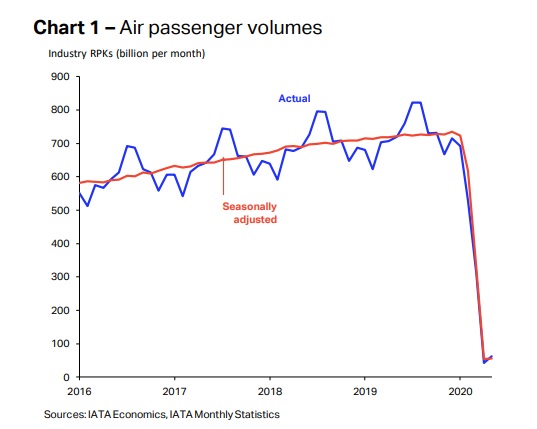

Although air travel demand lingered around its historical minimum amidst COVID-19, the annual contraction was marginally smaller than that recorded last month. Revenue passenger-kilometres (RPKs) fell by 91% year-on-year in May vs. a 94% decline in April. Seasonally adjusted RPKs lifted by ~1%.

Domestic markets show signs of recovery

The smaller annual decline in industry-wide RPKs this month reflects tentative signs of recovery in some of the domestic markets which started to reopen. However, aggregate domestic demand was still down almost 80% year-on-year in May. International RPKs contracted by close to 100% for a consecutive month since most countries either kept their borders closed.

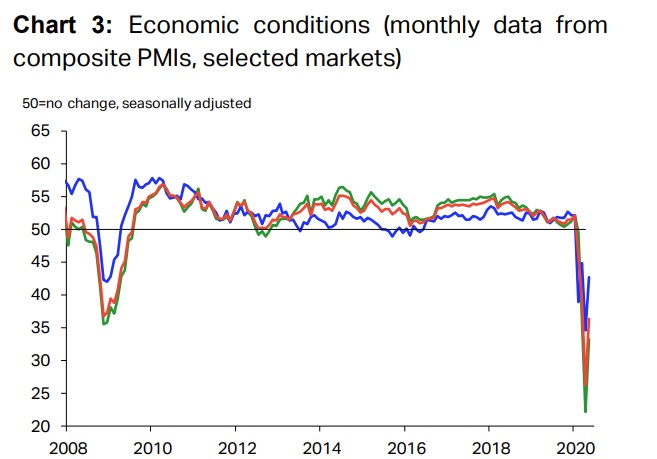

Demand drivers were unsupportive in May

The main drivers of air travel demand were unsupportive of RPK developments in May amid the adverse impacts of the COVID-19 crisis. Despite a moderate rebound from the April low, operating conditions in the manufacturing and service sectors remained challenging and pointed to a further deterioration in GDP growth in the second quarter across advanced and emerging markets.

Moreover, unemployment rates have spiked around the globe, weighing on the available income of potential travelers.

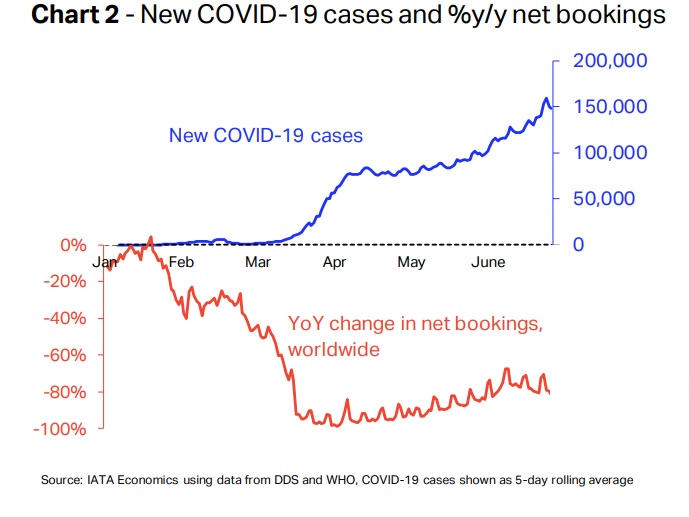

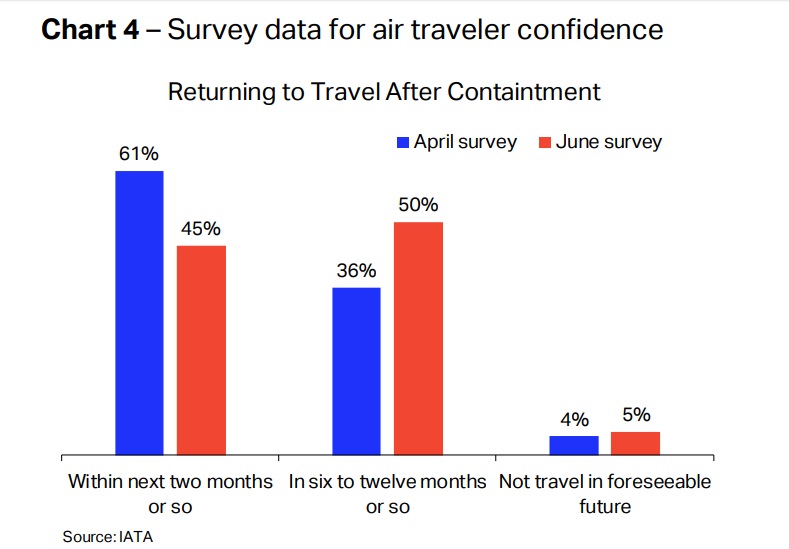

Passenger sentiment remains subdued. According to the latest survey conducted in June, travelers have become more cautious about air travel than three months ago. A total of 45% of respondents stated that they were intending to fly within two months from the time the pandemic is contained, down from the 64% share recorded in April’s survey. The majority now anticipates a return to air travel no sooner than in six months.

Based on the latest estimates, air travel demand will start its gradual recovery in Q3 and Q4, but reach 2019 levels only in 2023. Restoring consumer confidence about flying will be one of the crucial elements for this recovery.

Domestic markets to recover first

Domestic markets are expected to lead the industry recovery from the crisis. Some of the key domestic routes that we regularly track have already shown signs of improvement in May and June. The number of flights has been increasing slowly but surely on the US and Japan domestic routes in June. The Russian market has shown one of the fastest rebounds so far, with flights down ~40% year-on-year in the second half of June, compared to an 80% decline in April. China has been registering demand improvement since mid-February, providing some guidance for the possible path of recovery in the rest of the industry. However, that gradual improvement has been more recently interrupted by flight cancellations to and from Beijing amidst an increase in the number of new infections.

International demand will take more time to recover.

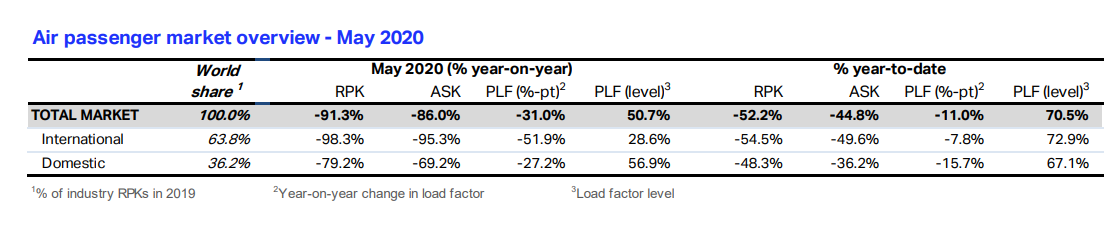

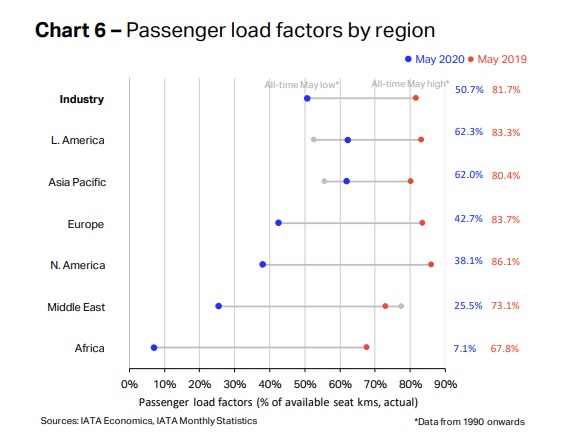

The rebound will depend on reducing the risk of virus transmission from one country to the other as well as on the strictness of quarantine and other restrictive measures after passenger arrival. Load factors reach record lows for another month Industry-wide available seat-kilometers (ASKs) contracted by 86% year-on-year in May – a decline broadly unchanged from the previous month (-87%). Despite widespread aircraft grounding and flight cancellations, passenger demand fell five percentage points faster than capacity over the past year. As a result, the industry-wide load factor dropped by 31ppts on a year ago (vs. 47ppts in April), reaching a new record-low for the month, at 50.7% (Chart 6). The sharp falls in load factors were broad-based with airlines in four of the six regions marking new record lows this month. The largest PLF declines were recorded by African carriers (down more than 60ppts yoy), reflecting both a larger decline in demand and a smaller capacity adjustment than the industry average. Asia Pacific and Latin America were the only regions to deliver a load factor above 60% this month; a decline of around 20ppts compared with a year ago. Looking ahead, capacity planning in the near-term will be especially challenging for airlines. There are indications that passengers have changed their booking behavior amidst the COVID crisis, buying their tickets much closer to the date of departure than was the case previously. This change in the timing of ticket purchases has reduced airlines’ visibility on future demand in an already highly uncertain environment.

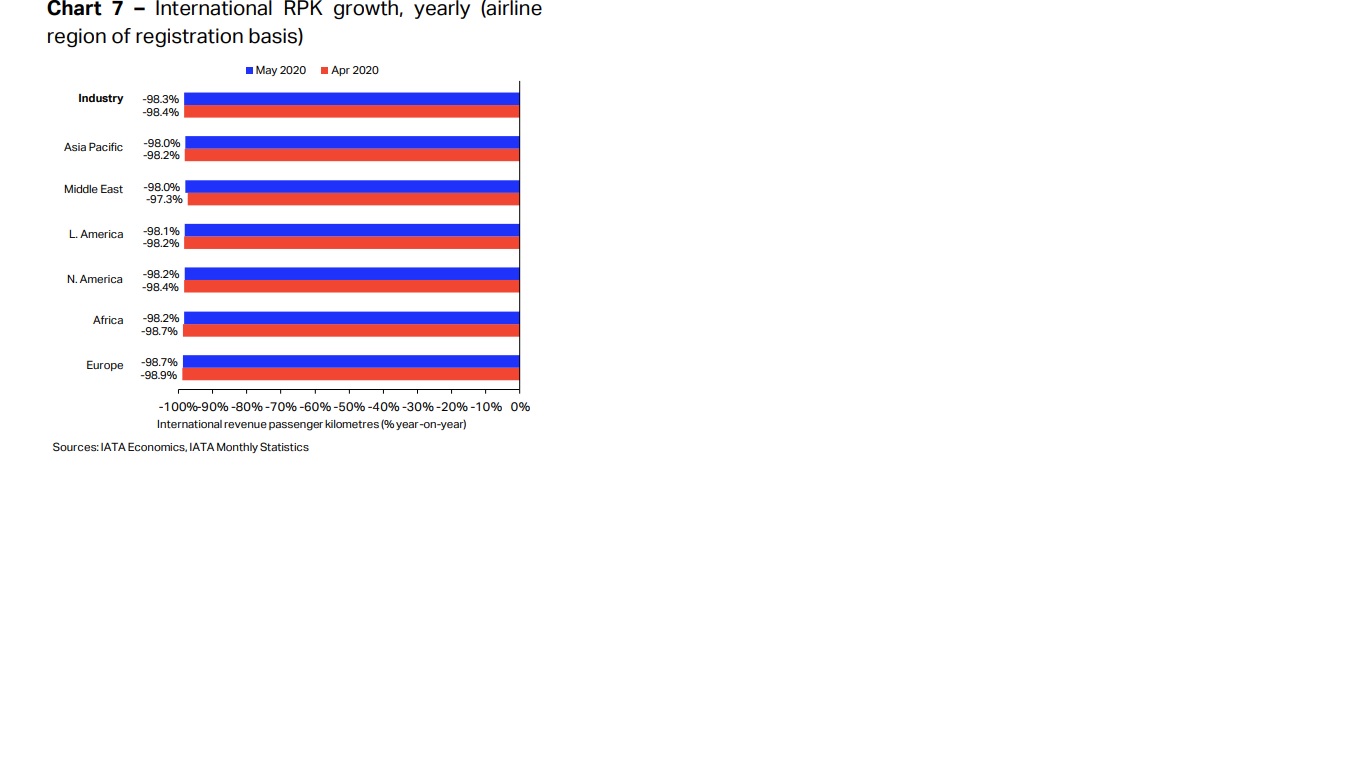

Int’l demand remained down amidst border closures

International RPKs declined by 98.3% year-on-year in May – essentially unchanged from -98.4% in the previous month. The annual fall of close to 100% was broad-based across all regions (Chart 7) and key international routes.

That said, seasonally adjusted passenger volumes lifted slightly in the Asia Pacific region since China and South Korea restored some of its international flight connections in May. The gradual opening of borders and, for some countries, the creation of travel ‘bubbles’ or ‘corridors’ should result in further gradual improvement in international RPKs over coming months.

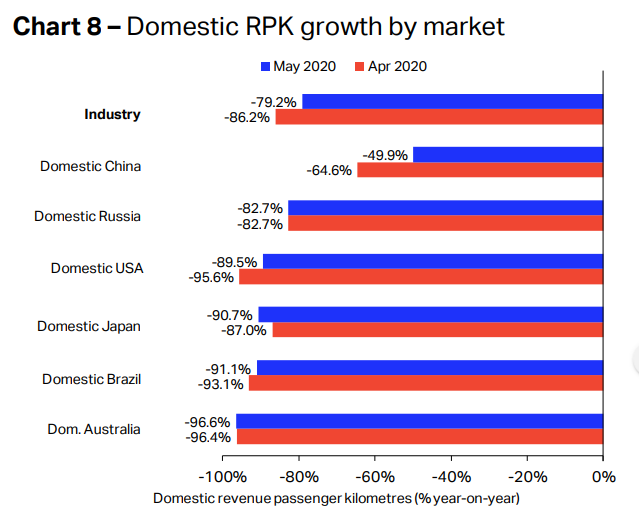

Domestic RPKs showed signs of recovery

The latest data show that domestic markets performed comparatively better than international routes this month. Domestic RPKs contracted by 79% year-on-year in May, compared to an 86% annual fall in April.

Seasonally adjusted RPKs also moved higher, up 34% month-on-month. China was one of the key markets contributing to the overall improvement, with the RPK contraction slowing by 15ppts to -50%yoy. Its domestic load factor also fared comparatively better than in other key domestic markets (at 69%).

The US domestic market also showed a smaller annual decline in May, with RPKs down 90% year-on-year compared to 96% contraction in April. The remaining key domestic routes recorded broadly unchanged annual falls from the previous month. In fact, the rate of decline accelerated modestly in domestic Japan (-90.7%yoy) and Australia (-96.6%). Domestic Brazil was the only market where the annual fall in capacity broadly matched the contraction in demand. Its load factor was the highest amongst the key domestic routes (71.2%) and also fell less dramatically than in the other main domestic markets (down 11ppts).