The Board of DCI, a leading investor in high-end residential resorts in the eastern Mediterranean, is pleased to announce that it has entered into a conditional agreement for the disposal of its 100% interest in Amanzoe and the sale of 20 Kilada Hills Golf plots to Grivalia Hospitality S.A..

Grivalia is managed by Grivalia Properties, a real estate investment company listed on the Athens stock exchange, and also acquired DCI’s interest in Pearl Island, Panama in January 2017.

The Disposal cash consideration payable to Dolphin for Amanzoe is €5.8 million and the acquirers will also assume all existing liabilities of Amanzoe which amounted to €110 million as at 31 December 2017 (€74 million of which were borrowings).

Amanzoe comprises a luxury hotel resort and beach club, 13 sold villas (8 of which have been delivered) and in excess of 20 available villa plots for sale. The hotel generated EBITDA of €4.5m in 2017.

The Disposal consideration reflects an enterprise value of €116 million for Amanzoe, representing a premium of 8% to DCI’s gross asset carrying value as at 31 December 2017 and will result in a surplus over carrying value on sale of €9 million.

Grivalia will purchase DCI’s entire stake in Amanzoe through the acquisition of 100% of the shares in DolphinCI Fourteen Ltd, the holding company owning the project, and all related entities currently owned by the Group. Completion of the Disposal is conditional on the completion of certain procedural steps for the transfer of the respective shares and the finalization of certain legal opinions relating to the transaction. The Board expects that these will be finalized, or waived, by the end of September 2018.

At the request of Grivalia, the asset management of Amanzoe will be continued by Dolphin Capital Partners Ltd, the Company’s Investment Manager, who will also acquire a 15% equity stake in Amanzoe from Grivalia on pari passu terms following the completion of the Disposal.

As part of the Disposal, Grivalia have contracted to purchase 20 Golf plots in Dolphin’s Kilada Hills Golf project for a €10 million cash consideration, conditional on the Company securing a senior development loan for the project, the issuance of final building permits and the tendering of a construction contract for the project’s first phase development.

The proceeds from Amanzoe cash consideration and the sale of these plots, less attributable costs, combined with the senior development loan which the Company is currently negotiating with a local bank, are expected to provide sufficient funds to enable Dolphin to complete the development of the first phase of the project. The first phase will include a championship 18-hole Jack Nicklaus Signature Golf Course (the plans for which are already in place), a Club House, a Beach Club and the infrastructure for the first cluster of residential Golf plots that will be made available for sale.

The Disposal is in line with the Board’s decision to accelerate asset divestments, and follows the Group’s sale of its shareholding interests in Sitia Bay Resort and Triopetra Resort in Crete earlier this year. Importantly, the completion of the first phase of the Kilada Hills development, the Company’s most valuable asset in terms of net asset value as at 31 December 2017, is expected to unlock significant value.

The consideration for the 20 Kilada Golf plots reflects a significant premium to DCI’s gross asset carrying value as at 31 December 2017, after taking into account both their share of the overall

development costs incurred on the project to date and the estimated attributable infrastructure costs to be incurred.

Of the total €5.8 million cash consideration for Amanzoe, €0.5 million has been already paid by Grivalia in the form of a non-returnable deposit and €5.3 million will be paid upon completion of the Disposal. The €10 million cash consideration for the purchase of the 20 Kilada Hills plots will be paid in instalments, in line with the draw-down of the senior construction loan for the development of the first phase of the project.

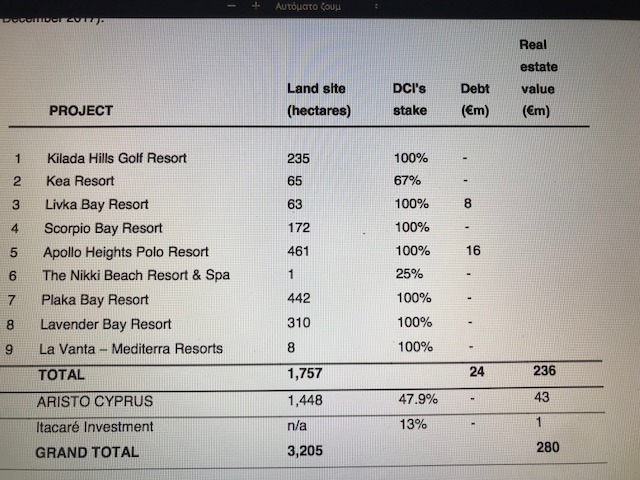

The Disposal reduces total DCI Group loans from €98 million as at 31 December 2017 to €24 million, resulting in a pro forma gearing ratio for the Group of 8% (31 December 2017: 25%). All of the remaining debt is asset based and non-recourse to DCI.

Following the completion of the Disposal, DCI will hold the following properties (figures as at 31 December 2017):

Commenting on the disposal, Andrew Coppel CBE, Chairman of the DCI Board, said:

“The Disposal reflects our commitment to generate liquidity through the reduction of the Group’s overall leverage and financing costs whilst, in parallel, delivering value for our shareholders through the development of the first phase of the Kilada Hills Golf project. Following our JV with One&Only for the development of the One&Only resort at Kea, this Disposal is expected to provide the funds required for the development of the first phase of our Kilada Hills Golf project through the use of the €10 million Golf plot sales proceeds and senior construction loans and without any additional equity investment. We believe that the completion of the Jack Nicklaus Signature Golf Course, together with the project’s Golf and Beach Clubs and infrastructure, will substantially enhance the project’s value and divestment potential for shareholders.”

Miltos Kambourides, Company Founder and Managing Director of Dolphin Capital Partners, said:

“We are proud to have developed Amanzoe to its current status as an iconic asset which has been consistently recognized as one of the top resorts in the Mediterranean. We remain confident that it will continue to offer its guests and villa owners the highest quality of services. This is an important Disposal for DCI as it is expected to provide sufficient funds to enable it to develop the first phase of Kilada Hills, our most valuable asset, with no additional equity contribution from the Company.”