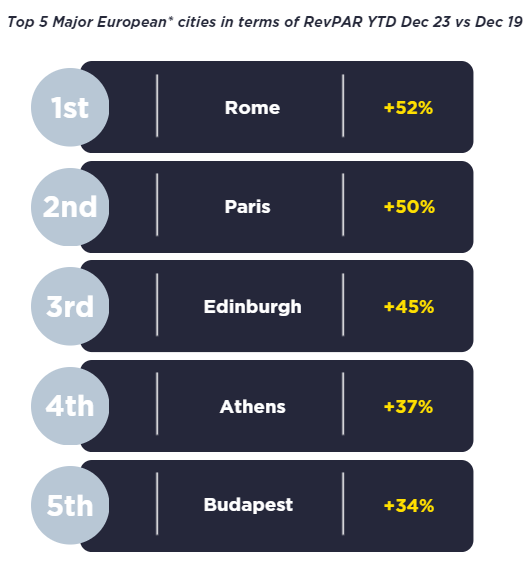

Athens is among the top five cities in Europe with the highest increase in revenue per available room (RevPAR) in 2023, compared to 2019, with an increase of 37% in Athens hotels. While the highest increase was recorded by hotels in Rome, according to new research by international real estate firm Savills on investments in the European hotel market.

The Savills European Investor Sentiment Survey 2024 found that the five European cities that recorded the largest increase in RevPAR in 2023 compared to 2019 were Rome (+52%), in first place, with Paris (+50%) in second, Edinburgh (+45%) in third and Athens (+37%) and Budapest (+34%) in fourth and fifth place, respectively.

The Savills European Investor Sentiment Survey 2024 found that the five European cities that recorded the largest increase in RevPAR in 2023 compared to 2019 were Rome (+52%), in first place, with Paris (+50%) in second, Edinburgh (+45%) in third and Athens (+37%) and Budapest (+34%) in fourth and fifth place, respectively.

The aforementioned markets have seen stronger average daily rate (ADR) growth, and alongside the faster recovery in occupancy is the strongest international appeal in the leisure sector.

The total volume of hotel transactions across Europe (including the UK) in 2023 amounted to €13.33 billion, down 26% year-on-year, but a further recovery is expected this year.

In the second half of 2023, investment activity showed promising signs of recovery, characterised by successive quarterly increases. In particular, regional volumes increased by 20% on a quarterly basis during the third quarter, a remarkable development given that the third quarter traditionally sees sluggish activity.

Although second-half volumes still show a 19% year-on-year decline, this represents a significant improvement compared to the sharp 32% drop in the first half of the year.

Last year, the UK emerged as the largest hotel investment market, a position held by Spain in 2022. However, in 2023, the UK will be the first country in the world The UK regained the lead, recording hotel transactions of €2.62 billion, marginally ahead of the €2.61 billion recorded by Spain. This was driven by a significant increase in UK activity in the last quarter, aided by lower borrowing costs and an improved investment climate.

This year, the size of investments is expected to exceed 2023 levels, as already the transaction volume for hotel properties in the UK is expected to increase to a record high. In the UK, transactions in the property market in the UK are already exceeding €1 billion.

While activity in Spain slowed last year compared to 2022 levels, the sentiment remains strong with continued appetite for leisure-focused assets and the prospect of repositioning, focused on luxury and upmarket categories, which is also seen in other Mediterranean markets such as Portugal and Italy.

The survey also shows the significant willingness of investors to increase their presence in the hospitality sector over the next three years. Survey respondents expect to invest around €10 billion in this period alone, targeting in particular serviced apartments, lifestyle and mid-market hotels.

Commenting on the study’s findings, Richard Dawes, head of Savills’ hotel division in the Europe, Middle East and Africa region, said: “In the second half of 2023, investment activity showed promising signs of recovery, characterised by successive quarterly increases. Regional volumes increased by 20% quarter-on-quarter during the third quarter, a remarkable development given that the third quarter traditionally sees sluggish activity. This momentum continued with stronger volumes in the first quarter of 2024 in several key markets in the region.”